For a few wild weeks in late January and early February, the eyes of the investing nation—from the financial media to evening news anchors and even our legislators in Washington, D.C.—were unexpectedly focused on a handful of relatively obscure stocks, names that barely would have rated a mention just a few weeks before. Due to a specific blend of overextended hedge fund managers, organized and motivated message-board traders, and even some temporarily cash-flush young investors with federal stimulus dollars to burn, video game retailer GameStop (Ticker: GME) suddenly took the investing world by storm, sweeping up a few other similar companies in a frenzy that even managed to steal a few headlines (for once) from the continuing COVID-19 pandemic. Seemingly overnight, the concepts of “short selling”, “short squeezes”, and “payment for order flow” had entered the public vernacular, as conversations about seemingly mundane topics (market structure, trade settling procedures, stock derivatives, and more) suddenly became commonplace.

As investment managers, we watched the proceedings with an interesting mixture of wonderment and bemusement, while wondering aloud how long the frenzy might last. While the immediate market craziness seems to have died down—at least for now—what remains to be seen is whether this will be just another soon-to-be-forgotten investing fad, or if the events of the last few months will have long-lasting implications for market participants, either via investing behaviors, regulatory changes, or even who chooses to invest money in the markets (and with whom). We’ll try to sort through what happened, why it happened, and what it might mean for your own investing strategies.

What happened?

By now, many folks are familiar with the basic outline of the situation: struggling retailer GameStop had become the target of short-selling hedge funds who made sophisticated bets against the company, aiming to profit from a plunge in its stock price. In many cases, the funds did so with high levels of leverage, making them particularly vulnerable to even a small increase in the daily share price. A few well-informed market participants noticed this vulnerability, gathered together on Reddit message boards, and decided to bind together to purchase large blocks of GME, hoping to make the hedge funds lose money as the share price grew. Ultimately, their attempts worked almost too well—the purchases sent GME stock surging rapidly higher, many funds were forced to buy the stock back at higher and higher prices in order to stop losing money, and a classic “short squeeze” was underway.

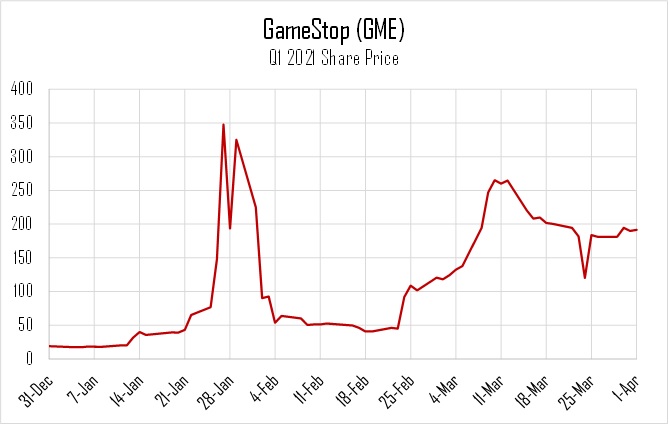

Soon, the entire world seemingly took notice, and an army of small retail traders—many of them using the zero-fee trading app Robinhood—started actively trading GME, along with a handful of other similar companies. Tiny little GameStop was suddenly the most heavily traded company in the market, surging more than 400% in less than a week while garnering more interest than big-tech behemoths like Apple, Amazon, Google, and Facebook. Unfortunately for the “little guys”, the ride would not last long. The spike in trading volumes created problems for the brokerage firms tasked with clearing the trades (Robinhood included), and those firms soon restricted trading in GME shares, at one point limiting traders to “liquidation-only” trades (meaning that they could sell shares they already owned, but could not buy new shares).

Source: Yahoo! Finance

The public reaction was immediate and fiercely negative. In the eyes of the investing public (and many elected officials), the “little guy” had beaten Wall Street at its own game for once, and just as quickly, the empire struck back and changed the rules of the game on the fly. This David-versus-Goliath narrative is an engaging simplification that certainly makes for good headline fodder, but one that largely obscures the truth. The reality is both complex and mundane, and in fact includes enforcement of certain regulations that were intended to protect small retail investors from exactly these sorts of market hijinks. Still, the event captured the public imagination in a way that the financial markets rarely do, and there are likely to be at least some implications for market structure and regulations going forward.

What does it all mean for you?

For most investors, the entire episode should serve as an entertaining sideshow, and not anything that should impact how they invest, or what they invest in. For starters, even at the peak of the GameStop rally, the company’s market value reached a maximum of about $30 billion, representing just 0.06% of the U.S. stock market—yes, fortunes were made and lost for many folks on this stock, just as they are made and lost in Las Vegas every day, but this is not the type of stock that has long-term meaning for the majority of investors or for the broader economy. That said, the noise surrounding the stock also revealed a number of lessons that can indeed be valuable for every investor, if only as a reminder of what (or what not) to do.

First and foremost, it is always important to keep in mind that risk and reward go hand in hand—volatile stocks may offer potential for large “get rich quick” gains, but money can be lost just as quickly. The week after GME stock more than quadrupled, it fell by 80%, from above $300 to just $60. In fact, the average weekly change in GME’s share price this year has been 79%, either up or down. Many investors who bought and sold at the wrong times lost fortunes; market-timing is difficult even for professional investment managers, let alone for the average retail trader in a volatile stock.

Even for more passive index investors, though, the GME story has relevance. As the stock soared, a number of passive funds ended up with large weightings of GME, likely without investors noticing. Most notably, the S&P 500 Retail ETF (Ticker: XRT) saw its GME weighting grow to 20% of the fund, more than 5 times as large as the next-largest holding. If you owned XRT thinking that you owned a well-diversified sector ETF, you might have been surprised to learn that the risk-reward dynamics of your investment had greatly changed, essentially overnight. As usual, understanding the structure and strategy of the stocks, funds, and other investments you own (and not just the name on the wrapper) is vital.

At Cypress, we try our best to avoid being swept up in the market frenzy of the day, regardless of the flavor. Yes, there is often money to be made following investing fads, but that money can often be lost just as quickly, sometimes without warning. Knowing your risk tolerance, investing time horizon, and actual investing goals are always the core elements of any investing strategy. Sometimes, a thoughtful allocation to a high-risk, high-reward investment can be an important part of a long-term strategy. But risk management is crucial, and emotion can too often rule the day. Cool heads must (and will) ultimately prevail.

This post is not an offer or a solicitation to buy or sell securities. The information contained in this post has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This post may not be construed as investment advice and does not provide any investment recommendations.