Before November’s election surprise, the biggest market-moving story of 2016 was the unexpected result of the Brexit vote in late June, in which the U.K. voted in a referendum to withdraw from the European Union. The market reaction—both in stock markets and in currency markets—was swift and severe, marked most notably by a rapid depreciation in the British Pound.

In the nine months since the vote, minimal progress has been made toward determining how and when a withdrawal will occur (though U.K. Prime Minister did formally trigger “Article 50” on March 29th, so as to officially begin the withdrawal process), but the markets have not been nearly as quiet. Despite significant initial jitters, investors have largely shrugged off any uncertainty about the potential reshaping of the European economy, and international markets have in fact outperformed U.S. markets since the vote took place.

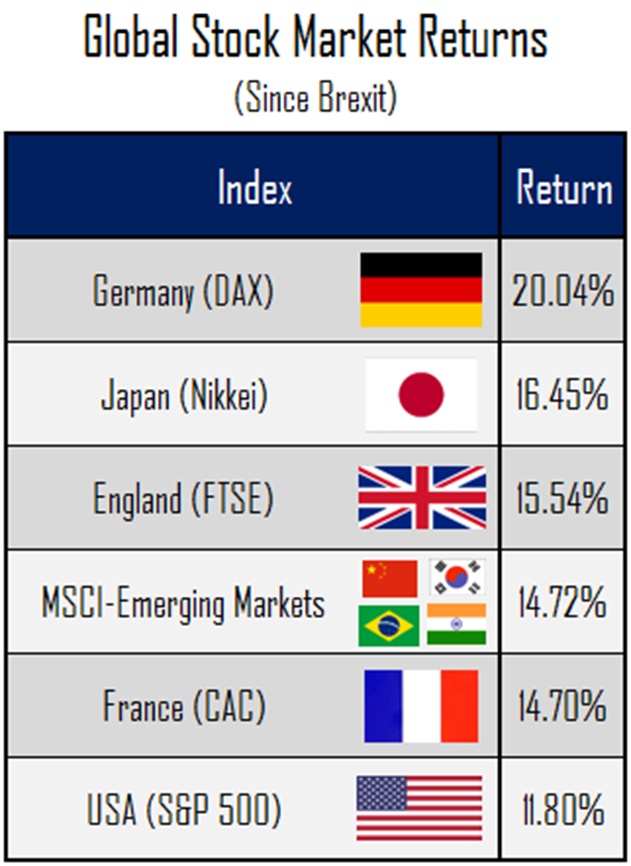

London’s FTSE 100 Index—which shed nearly 6% in the two days following Brexit—has recovered and then some, ending Q1 at a level more than 15% above its pre-Brexit levels. Germany, which is the largest member of the European Union and theoretically stands to lose the most from a potential breakup of the bloc, saw an even more dramatic turnaround in its markets—after losing nearly 10% after the vote, shares have rebounded to levels more than 20% higher than before the vote. Even Asian markets in Japan and China, which were volatile throughout 2016 as waves of anti-globalism swept across the world, have stabilized and been among the strongest performers over the last 12 months, even despite a period of underperformance in Q4 stemming largely from the “Trump effect”.

Source: Yahoo! Finance

For investors who have watched their allocations to international stocks trade essentially sideways for the better part of a decade, the recent trend of outperformance likely arrives as something of a pleasant surprise, coming as it does amid almost persistently negative headlines in Europe and elsewhere.

While some developments over the coming weeks and months could certainly derail that trend—the Brexit process, continued weakness in Italian banks, and a number of other upcoming European elections are all likely to garner their fair share of headlines—the lesson for now is somewhat clear. No matter what the day-to-day noise of the markets might suggest, keeping a long-term focus is almost always the best approach.

When nervousness about political uncertainty or central bank policies or even military conflict causes volatility in markets, keeping a cool head and taking advantage of the opportunities that reveal themselves can often be quite profitable in the long run. At Cypress, we continue to believe that exposure to global markets is an integral and valuable part of any diversified portfolio strategy. As always, we will continue to monitor overseas developments that may suggest changes to that approach, but for now, we take comfort from the markets’ recent reactions to ongoing current events.