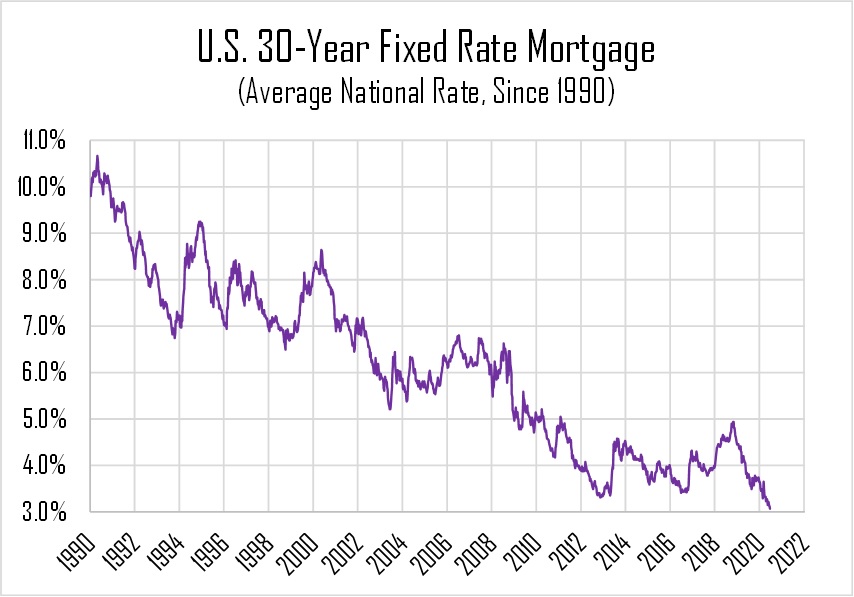

As stock markets tumbled in February and March, real estate was similarly impacted, but the recovery in that sector has been generally weaker (and arguably even more uneven) than the recovery in the broader stock market. On the positive side, mortgage rates have plunged once again to historic lows, and lending lines—briefly frozen in March—are back open and mostly functioning as the

economy begins to stabilize. But the tailwinds of lower financing costs have not been a salvation for all real estate, whether on the residential or commercial side.

Source: St Louis Fed (FRED)

Most of the dynamics we’ve seen so far can be explained by expectations of what a “post-COVID” world might look like—if a shift to teleworking and virtual offices becomes commonplace (and if widespread closures of bars, restaurants, and other entertainment and gathering venues become permanent), then a societal shift from urban settings to more suburban/rural environments may begin to take hold. On the residential side, this could mean a sharp increase in property values in secondary markets and areas, as property owners begin to flee dense urban centers. This flight has already begun to occur (at least anecdotally) in the New York City area, where properties on Long Island and other suburban communities have seen much more activity and price gains in recent weeks than in Manhattan proper. A shift to teleworking would also be bad news for many commercial properties, especially in those same dense urban centers. For us as investors, we do see substantial opportunity in real estate, as long as exposure to the most vulnerable sectors (and geographic areas) can be managed. We remain comfortable with our positioning, and we encourage both clients and prospects to reach out with any questions they may have about COVID’s likely impact on their real estate holdings, whether their own properties (primary or vacation/rental) or those held in their investment portfolios via REITs.