As the fourth quarter begins and our pumpkin-spice-fueled thoughts begin drifting toward the busy upcoming holiday season, it’s hardly surprising that many of us fail to give our workplace benefits the attention they deserve. Indeed, with another open enrollment season right around the corner, employee benefits provider Unum warns that nearly half of employees will spend 30 minutes or less reviewing their benefits options before enrolling. Furthermore, a staggering 93 percent of employees simply choose the same benefits year after year, even as their life circumstances (and often, the specifics of the benefits themselves) may have changed.

That lack of attention could have significant financial implications, and a suboptimal benefits election is usually not correctable until the next year’s open enrollment period rolls around. While it’s easy to be overwhelmed with all of the complexities and constant changes in the benefits landscape, it’s worth taking some extra time to understand the options being offered, and to consider whether a new approach to your benefits might be warranted. We’ll spend some time summarizing some of the key benefits decisions, and how to think about the relative value of different options.

Health insurance considerations

Searching for major plan changes

As the cost of health care continues to rise, so too does the cost of health insurance, both to the employer and to the employee. In order to help manage (or perhaps disguise) the increases in cost, a number of changes to the details of plans can occur from one year to the next. Even if the name of a specific health insurance plan doesn’t change, some of the specifics of the coverage can, and it’s important to know where to look.

What is the deductible? What about copays and/or coinsurance amounts? Are your preferred doctors and/or hospitals still part of the primary network, or not? Most plan providers offer the ability to search for doctors in your network, so it might not take long to confirm whether or not your benefits will cover what you want them to cover.

And if your travel habits (for work or for pleasure) have changed from one year to the next, then it might be worth investigating the extent to which your plan covers out-of-network expenses, in case you require medical treatment while you’re away from your primary residence (and home health insurance network).

Finally, changes in life circumstances and expected health expenses can change the optimal plan for the upcoming year. Are there any major medical procedures that you’re considering for the next year, or are you or your spouse pregnant and planning for the costs of labor and delivery? Understanding and projecting your likely costs is an important part of deciding which plan to choose; simply assuming that annual medical costs will be the same from one year to the next can be a dangerous (and costly) mistake.

To HSA or not to HSA?

The rise of insurance premiums has also fueled a rapid growth in high-deductible health plans (HDHPs), which are often paired with tax-advantaged Health Savings Accounts (HSAs). For employees who can afford to pay out of pocket for the typical medical expenses (either because their annual medical expenses are low or because their wealth is high enough to absorb the risk, or both), electing an HSA-eligible health insurance plan can open up a new opportunity for tax savings.

For the 2020 tax year, participants in eligible HDHPs can contribute up to $3,550 per individual (or $7,100 per family) of pretax money to HSAs, which will be an above-the-line deduction for income tax purposes. Once in an HSA, these funds can be invested until needed, and any investment earnings on the funds will be exempt from current-year taxation. If and when the funds are needed for qualifying medical expenses, they can be removed from the account completely tax-free. HSAs, then, are said to be “triple tax advantaged” (upfront tax deduction, tax-free growth, tax-free distributions) if used appropriately. Best of all, there is no expiration date by which HSA funds must be used—in fact, if desired, HSAs can be used as a sort of retirement medical savings vehicle, to help defray the future costs of health care in retirement.

For individuals or families with high medical expenses or tight household budgets, the HDHP/HSA route might be inappropriate—deductibles can vary for these plans, but the IRS requires that they be at least $1,400 per individual (or $2,800 per family) for the 2020 tax year. But for those who can afford to self-insure at lower levels of expenses, the HSA is an incredibly valuable tool.

Other benefit options to consider (or reconsider)

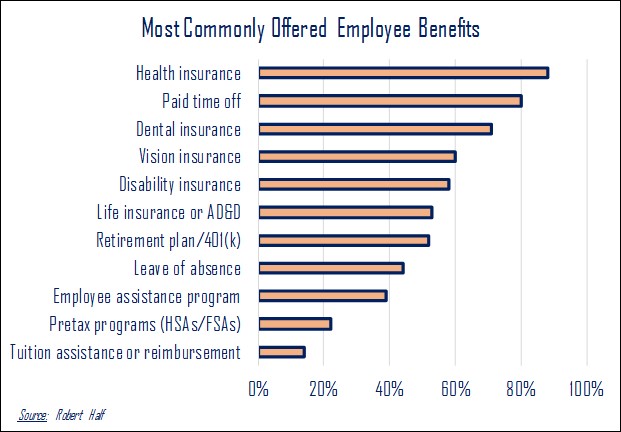

Health insurance is the most common employee health benefit (and typically the most expensive), but it’s hardly the only one to consider. Retirement plan specifics can also change from year to year, and it’s worth taking time to familiarize yourself with the new options, if any. Has the employer match formula been updated? Or has your household cash flow situation changed in a way that enables you to contribute more (or less) to the retirement plan for the upcoming year?

Taking stock of how much you’ve saved already—and how much you still need to save to meet your retirement goals—can inform the contribution rate that you select for the upcoming year. In addition, investment options may have changed—there may be new investments available that you hadn’t previously considered, or the expense ratios (fees) on the existing investments may have been reduced (or increased), changing their overall attractiveness. With all of the changes in the interest rate environment over the last 12-18 months, it may be worth reassessing any fixed income investments you may have, to ensure that the interest being paid is competitive.

If your family circumstances have changed due to a new birth (or death), it may also be worth reconsidering insurance coverages, or updating beneficiary designations on existing retirement accounts and insurance policies. Finally, some employers are constantly adding new and creative benefits, from employee wellness programs to student loan assistance, and more. At Cypress, we’re always ready to help our clients think through their benefits decisions, in order to understand how various options fit in with their short and long-term financial goals.