By most metrics, the U.S. economy has fully recovered from the 2008 financial crisis and recession: housing prices have exceeded their pre-crisis peak, the stock market remains at stratospheric levels (even after its late-year stumble), and unemployment measures stand at multi-decade lows. However, the recovery has been extremely uneven, with the gains concentrated in increasingly few hands. Many areas of the country remain mired in a decades-long economic malaise, and even the affluent urban centers like New York, Los Angeles, and San Francisco have seen a dramatic expansion in income inequality, with some neighborhoods left completely behind.

While the Tax Cuts and Jobs Act of 2017 has been criticized for helping to exacerbate those inequalities, there is one largely overlooked item in the tax reform act that aims to correct at least some of that growing imbalance. In an attempt to spur investment in underdeveloped areas, Congress created a new program that may have tax and investment implications for a wide range of investors. We’ll explain the mechanics of the program, the potential benefits and drawbacks, and help to determine whether or not average investors should be taking notice.

What are Opportunity Zones?

Initially conceived of by a diverse group of billionaires and politicians—stemming from both sides of the political aisle—so-called “Qualified Opportunity Zones” (also known as QOZs or “O-zones”) offer investors a new and innovative tax incentive for investing in specific underprivileged areas. First discussed in earnest during the leadup to the 2016 election, the O-zone concept eventually evolved into a somewhat unlikely add-on to the 2017 tax reform law.

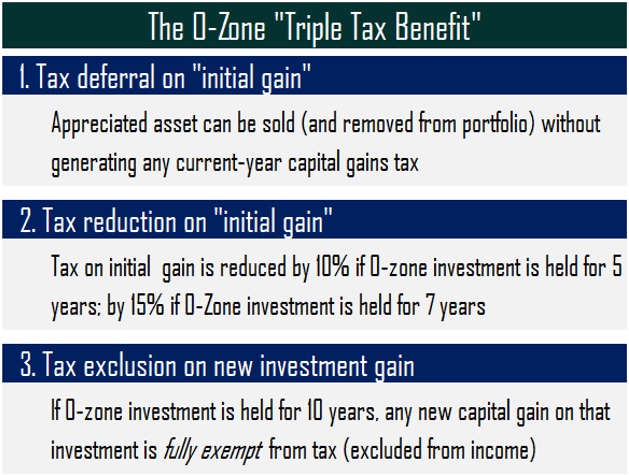

Mechanically, the concept is fairly simple, relying on a trio of attractive new tax breaks: investors who sell appreciated assets (real estate, stocks, or other securities) with embedded capital gains can, within 180 days of the sale, reinvest the capital gains portion of their sale into an approved Qualified Opportunity Fund (QOF). The reinvestment in the QOF will allow the investor to defer tax on the realized capital gains, which is the first level of tax incentive.

Then, depending on the investor’s holding period, additional tax breaks can accrue: investors who remain in a QOF for at least 5 years can reduce the tax bill on their initial capital gain by 10%, while those who hold for at least 7 years qualify for a 15% reduction. Finally, investors who remain in a QOF for 10 years or longer will enjoy fully tax-free growth on any gains stemming from the QOF investment. In a sense, then, any funds invested in a QOF essentially become a special-purpose Roth IRA, allowing tax-free investment growth for the investor.

For the long-term investor, the benefits from the various tax incentives can be massive, especially if the QOF investment performs well. Of course, like most tax incentive programs, the benefits are greatest for the wealthiest investors—not only are they the ones most likely to have large capital gain assets in the first place, but their marginal tax rates are also the highest, increasing the value of the tax benefits.

In many ways, the QOZ concept is similar to existing tax-free exchanges (like 1031 exchanges for rental properties, or 1035 exchanges for insurance policies), but supercharged to allow for tax reduction. However, the application is also much more limited. In order for a specific census tract to qualify as an O-zone, it must have a poverty rate of 20% or higher, or a median household income that is less than 80% of the surrounding area. Per the final IRS list issued in 2018, there are more than 8,700 approved zones, spread across the 50 states (and 6 U.S. territories).

There are limitations on what kinds of investments will qualify, but for the most part, the opportunity set is broad. QOFs must ultimately hold 90% of their assets in projects located within O-zones, but they will have a relatively long time to deploy their investments (30 months, per proposed IRS guidelines).

Not surprisingly, banks and other funds have already begun scrambling to attract capital from investors, even before the rules surrounding QOZs have been finalized (and with the IRS currently severely understaffed due to the government shutdown, “final” guidance may still be a while coming).

The drawbacks

Of course, with great opportunity often comes great risk, as well. For one, the QOZ opportunity simply won’t be appropriate for many (or most) individuals or families. Many individuals have no retirement savings or investments outside of IRAs or 401(k) plans, and those vehicles are incompatible with QOFs. Only investors with accumulated capital gains in taxable accounts (or other non-retirement assets) are eligible, thus limiting the pool of potential investors.

And as with most new and poorly-understood opportunities, there are bound to be abuses and bad actors. Enhanced due diligence of any and all opportunities is paramount, in order to avoid chasing a bad investment simply in search of a potentially illusory tax benefit.

Even the best-vetted O-zone investments will likely come with higher risk. New Jersey Senator Cory Booker, a vocal proponent of the QOZ program, has referred to O-zones as “domestic emerging markets”, and it’s not just a euphemism: nearly 10% of the 8,700 designated zones are in Puerto Rico, which is, in fact, an emerging market economy.

Meanwhile, future changes in the tax code could mute or eliminate the tax benefits that QOF investors expect to receive. A complete repeal of the O-zone program is unlikely given its broad bipartisan support, but if the program proves to be less successful (or more expensive) than anticipated, that support could erode quickly.

No matter what, realizing the full benefits of an O-zone investment will require a very long-term investment, with significant limits on liquidity. Any funds committed to a QOF, then, should be funds that the investor does not expect to need for at least a decade. That may be an appropriate trade to make for a younger investor with decades to go until retirement, but less suitable for a retiree.

Given the potentially large benefits of O-zone investments, the program definitely seems to deserve more attention than it has received so far. However, given the vast uncertainties (and limited applicability), we recommend that all individuals proceed with caution. As usual, it’s rarely wise to let the tax tail wag the investment dog.