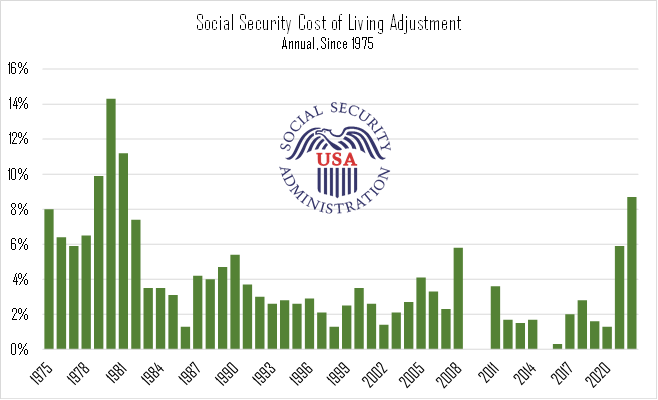

Stubbornly high inflation was the dominant story in 2022, causing issues for consumers, business owners, and economists everywhere. But high inflation can often come with a silver lining, due to inflation adjustments. Most notably, Social Security recipients will be seeing an 8.7% benefit increase in 2023, marking the largest cost-of-living adjustment since 1981, and far exceeding the 20-year average of 2.3%. The increase will be even more meaningful for retirees given that standard Medicare premiums are actually poised to decrease by more than 3%, from $170 per month to $165. With year-over-year inflation having cooled to 7.1% by November (and hopefully continuing to decline in 2023), that extra income could help soothe frayed nerves after an anxious year.

Of course, Social Security is not the only area of personal finance to be subject to inflation-indexing. Tax bracket cutoffs and standard deduction amounts will increase, as will contribution limits for IRAs, HSAs, and 401(k) plans. Limits for “conforming” home mortgages will also jump in 2023, which could help ease the sting of higher mortgage rates. All told, the various inflation adjustments could behave like a stealth “tax cut” for individuals on the margin. It may be necessary to reconsider savings rates and other strategies in 2023, to ensure that outsized inflation adjustments are properly accounted for.