With interest rates of all types sitting at or near historic lows, buying a car has rarely been easier. As a result, U.S. auto sales hit an all-time high of 17.47 million in 2015, and sales in the first half of 2016 continued at a record pace. But as vehicle prices also continue to climb, an increasing percentage of car buyers have turned to leases rather than outright purchases. Indeed, according to the credit monitoring firm Experian, the portion of new vehicles that were leased also set a record in 2015—a rate of more than 30%, up from 24% in 2010.

What explains the newfound interest in car leases over purchases, and might a car lease make sense for you? We’ll take a look at the main differences between buying and leasing, and the various implications for you and your overall financial picture.

The financial factors

From a financial perspective, it’s important to recognize that the out-of-pocket monthly cost will nearly always be lower for a lease than for an outright purchase, all other factors being equal. In simple terms, that’s because a car loan is based on the full price of a new car, whereas a lease payment is based on only a percentage of the car’s price tag (essentially, the spread between the car’s retail price and its estimated “residual value” at the end of the lease term).

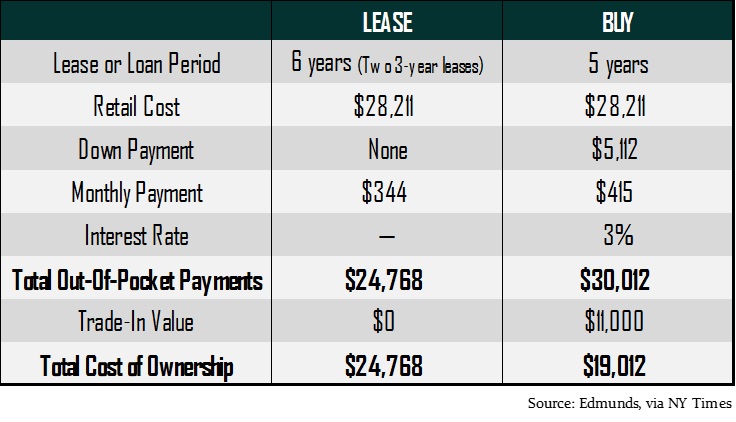

To demonstrate the point, analysts at the automotive information firm Edmunds evaluated the relative costs of buying or leasing a standard car (a 2014 Honda Accord, retailing for about $28,000) over a standard time horizon (six years, the average holding period for a new car purchase). In the case of the lease, the lessee actually signed two consecutive three-year leases, since a three-year contract is standard for most car leases (note that this also means two separate cars are involved rather than just one car, a point we’ll revisit later). In the case of the purchase, the car buyer made an 18% down payment, then financed the balance on a 5-year loan at 3% interest.

As expected, the projected monthly cost was significantly lower for the lessee than for the buyer—$344 versus $415, a difference of about $850 annually. Over the course of 6 years, the lessee would pay a total of $24,768 on 72 lease payments, whereas the buyer would pay a much higher total of $30,012 (between the down payment and 60 monthly loan payments).

However, at the end of the 6-year period, the lessee had nothing to show for their sizable expenditure—the dealer owned the car, and the lessee had nothing. The buyer, though, owned a 6-year-old car worth an estimated $11,000, which could either be sold in a private sale or traded in to a dealer. Subtracting that “residual value” from their out-of-pocket expenditure leaves a true cost of ownership of just $19,012 for the buyer, nearly $6,000 less than that of the lessee.

And while the Edmunds analysis did not explicitly say so, the overall financial advantage for the buyer increases the longer the holding period becomes, since the monthly payments cease for the buyer, but continue into perpetuity for the lessee (insurance and maintenance factors also come into play, but we’ll ignore them for now for simplicity’s sake).

The buy-versus lease decision, then, comes down to a simple tradeoff: the lease boasts lower monthly costs, but typically a higher total financial cost over time. Of course, since many potential buyers don’t have the budgetary flexibility to afford an extra $850 per year for the car loan (nor the $5,000 up front for the down payment), leasing can often be the only feasible option, despite its higher long-run cost.

Even for buyers who can afford the higher payment, though, the decision to purchase isn’t necessarily a slam-dunk. Remember, the extra money that is required in order to purchase the rapidly-depreciating car represents cash that can no longer be directed elsewhere, such as a retirement account or a college savings plan (or toward paying down other debt). For younger buyers with expensive student loan debt, or employees who might be sacrificing a 401(k) contribution in order to create budgetary room, that opportunity cost can be significant, eroding the financial benefits of buying.

Furthermore, maintenance considerations will need to be considered. In the case of two three-year leases, the lessee’s car will almost always be covered under a manufacturer’s warranty, and maintenance costs will by definition be limited. But the buyer will own the car long past the expiration of any warranty, and the costs of keeping the car on the road could quickly mount, further eroding the financial advantage.

Because those two factors can vary widely from person to person, they don’t lend themselves well to a simple analysis. That said, for most Americans with modest savings and positive cash flow, it’s likely that the most prudent course of action is to purchase an economical, reliable car, and to hold it for at least six years.

The lifestyle factors

Of course, the buy-versus-lease decision is not purely a financial question, but a lifestyle question as well. As we’ve established already, leasing a car enables a lessee to secure a newer, nicer car for a smaller out-of-pocket payment. That dynamic might help explain why the younger generation, already burdened by student loan debt, has turned to leasing in such overwhelming numbers.

However, car lease contracts often include a litany of potential penalties or fees that can increase the total cost of the lease and make leasing less attractive. Primary among these are annual mileage limits and wear-and-tear penalties, both of which can amount to thousands of dollars. A buyer who tends to put a high number of miles on a car might drive their leasing cost higher, as might a buyer who tends to be hard on their vehicles (perhaps they have children, or an off-roading habit). Yes, buyers might also have to consider the impact of those factors on the trade-in value of their car, but they won’t have to pony up extra money out of pocket, as a lessee would.

As with the purchase of a house, a number of situation-specific factors can impact the financial analysis. Is the residual value of the car in question expected to be high relative to the initial purchase price, or low? What investment return (or interest charge avoidance) can the lessee earn on any out-of-pocket savings? What other factors in the car buyer’s budget should be considered?

At Cypress, we’re happy to help clients consider how the various complexities of the car buying decision fit into their broader financial picture. Car buying doesn’t need to be a stressful experience; working to make an informed decision can improve your lifestyle without compromising your financial health.