With the negative economic headlines in the U.S. largely easing during the first quarter, there is only one obvious macro concern hanging over the market, but it happens to be a big one. The Brexit negotiations continue to drag on in Europe, and while an agreement has been reached to extend the deadline for the U.K.’s exit date from April 12th until October 31st, there doesn’t seem to be much evidence of any actual progress toward an acceptable solution. In the meantime, an intermediate deadline of June 30th looms, since a new session of European Parliament convenes on July 1st, and some progress update will certainly be required by then.

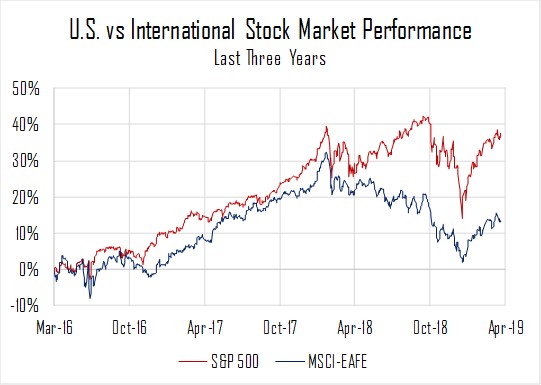

Source: Yahoo! Finance

To date, the consternation about the European stalemate has mostly manifested itself via tepid global market returns (international markets once again lagged U.S. markets in Q1), but a particularly sloppy Brexit will almost certainly have implications for all major global economies and markets. For Europe itself, though, exhaustion seems to be setting in, and Brexit may in fact be setting up similarly to the U.S. stock market environment leading up to the 2016 Presidential election: any outcome, even a “bad” outcome, could be cheered by the markets, simply due to the removal of long-standing uncertainty. One way or another, international businesses and investors just want to know what their new reality is, and how best to respond to it. Until then, nobody seems willing to stick their neck out to take outsized investment risks.